-

Where will the ethane for Project ONE come from?

The ethane for Project ONE is a by-product of shale gas. In the United States, shale gas extraction has made the region self-sufficient for energy. The ethane is extracted from natural gas: its extraction is needed to make the gas suitable for heating, for example. Ethane used to be flared on site for this reason, until it was realised that it could be put to good use in the chemical sector.

INEOS also extracts ethane from the North Sea, but there is not enough supply to meet European demand. Therefore, we import ethane from the US for Project ONE, where it is abundant. In the current political context, the US is the best alternative to ethane from outside Europe.

-

How does an ethane cracker differ from a naphtha cracker?

Today, ethylene is produced in two ways: ethane-based and petroleum-based (naphtha). Today, naphtha is the most widely used raw material in Europe. Project ONE, however, will work on the basis of ethane, a by-product of natural gas.

Ethane is today the most efficient feedstock for ethylene production. This is because the molecular structure of ethane already closely approximates that of ethylene. Naphtha is less selective for ethane: its cracking releases many more by-products. To produce 1.45 million tonnes of ethylene, our cracker consumes 1.9 million tonnes of ethane, while a naphtha cracker needs 4.8 million tonnes of naphtha. That’s more than double.

Moreover, crude oil has to undergo a lot of refining steps before it can be used as naphtha. Ethane production, as in Project ONE, emits less than half the CO2 compared to the naphtha-based alternative for this reason, among others.

To trigger the chemical reaction of cracking, you need a lot of heat and thus energy. Project ONE will get this energy from the hydrogen automatically released during ethane cracking. With this, we can already fill 60% of the heat requirement. In petroleum, there are on average only 2 hydrogen atoms per carbon, in ethane there are 3. So in a naphtha cracker, you will always have to sacrifice part of the petroleum as fuel to make the cracking process possible. With ethane, you choose the most energy-efficient production process, which contributes to much lower CO2 emissions.

INEOS also has its own naphtha crackers, which play an important role for the circular economy with chemical recycling and bio-based feedstock. However, for the production of pure ethylene, naphtha crackers are not as efficient as the Project ONE ethane cracker, so this is the best and most environmentally friendly way to produce pure ethylene. Instead of talking about a “fossil lock-in”, let’s talk about a “naphtha lock-in”. Project ONE’s ethane cracker will reshuffle the market by making CO2 more expensive for the oldest and most polluting installations.

-

What raw material does Project ONE use?

There is often confusion between raw materials and fuels used in the chemical industry. Fuels are burned for heating or transport, for example. In contrast, raw materials or feedstock are at the basis of a production process and are therefore not burned but used to create value-added products.

Project ONE uses ethane as its feedstock. More than 88% of the carbon in the feedstock ends up in products that retain this carbon and is therefore not emitted.

Ethane is the right feedstock to produce ethylene with the smallest carbon footprint. It replaces ethylene produced in Europe in older, more carbon-emitting plants that use naphtha as a feedstock. Project ONE’s carbon emissions are not even half of the 10% best European steam crackers today, we are doing three times better than the average cracker.

The large volumes of hydrogen released during the ethane cracking process will be repurposed by INEOS as a low-carbon fuel instead of natural gas. As much as 60% of the energy requirements of the crackers and steam boilers can thus be met without recourse to fossil sources.

-

Should INEOS not produce more bio-based plastics?

The introduction of bio-based raw materials for the production of plastics is a very promising evolution. Although it is not yet possible to make all plastics from bio-based raw materials, we are fully committed to increasing the amount of bio-based raw materials we use, especially in Belgium:

- Biovyn, production of PVC from biomass: at our INOVYN site in Jemeppe, we have made it possible to produce PVC with ethylene produced from a biomass that does not compete with food production. In this way, there is a reduction of CO2 emissions of more than 90 percent compared to production from fossil raw materials. This supply chain has been fully certified by the Roundtable on Sustainable Biomaterials (RSB), an independent third party. Biovyn can be found, for example, in the upholstery of the Polestar 3 car, but also in prosthetics and window profiles.

- Bio-attribution of renewable raw materials: ‘bio-attribution’ expresses the extent to which fossil raw materials have been replaced by renewable or bio-based raw materials. Ineos O&P North Lillo offers a range of Bio-Attributed Olefins and Polyolefins, based on renewable bio-based raw materials that do not compete with food production. Their supply chain is fully certified by the Roundtable on Sustainable Biomaterials (RSB), an independent third party.

-

Are there no alternative raw materials for the shale gas from the United States?

Today, there is no fully-fledged organic alternative to ethane.

The bio-based alternative bioethanol is only viable and acceptable from a sustainability perspective in places where it does not compete with the food industry. Given the amount of space required to have sufficient volumes, bioethanol is only used in very specific areas (such as Brazil with its sugar beet plantations).

Sugar beet produces 5,000 litres of ethanol per hectare or 3.95 metric tonnes of ethanol/hectare. Applying this to Project ONE: 633,000 hectares of sugar beet are needed to feed an ethane cracker to produce one and a half million ethylene. By comparison, Flanders has 622,000 hectares of agricultural land. So this integral area would not suffice on its own and would mean that this land could not be used for food production.

Similar reasoning applies to the availability of recycled raw material. In 2021, 30 million tonnes of mixed plastic waste was available in Europe. For a cracker with the capacity of Project ONE, you already need a third of that, while you would need 150 million tonnes for Europe’s current ethylene capacity. That is not simply not available right now.

-

Is there a demand for ethylene?

A company does not invest 4 billion in a project without first doing its homework thoroughly. The same obviously applies to INEOS and its investment in Project ONE.

There will still be a need for new ethylene and, of course, this ethylene must be produced as efficiently and environmentally friendly as possible. The market demand for ethylene with a low carbon footprint is significant and cannot be supplied by older and less efficient plants. Project ONE is therefore part of the solution.

So what is new ethylene needed for?

- To compensate for the degradation of plastics during mechanical recycling, new material must also be added. So for that, you always need new ethylene.

- To ensure certain high-performance applications where there is no risk tolerance for lower performance. For example, for medical applications, water transport pipes that need to last 100 years underground, wind turbines,…

The market forecasts an average annual growth in demand for ethylene of 4% over the next five years. According to IHS Market forecasts, ethylene will be imported into Europe for the next 5 years.

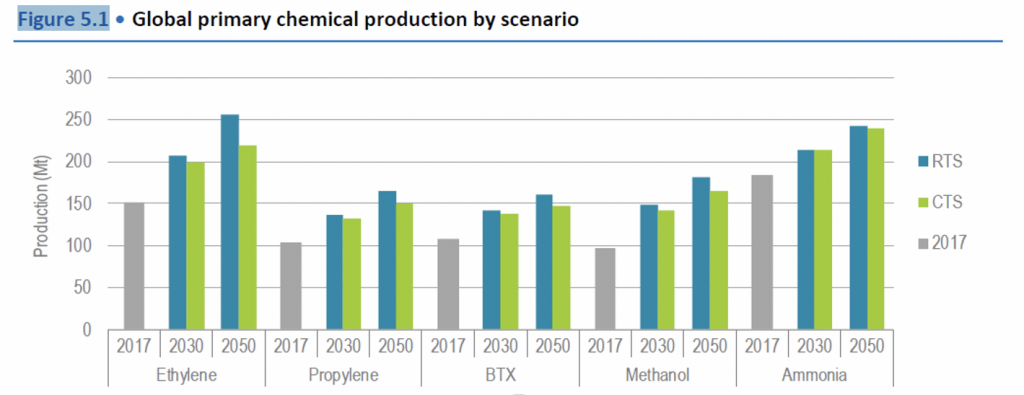

Even in the International Energy Agency (IEA) sustainable scenario[1], the demand for basic chemicals such as ethylene and propylene will increase by about 40 percent between 2017 and 2050. This is under the influence of a rising world population, rising prosperity and social evolutions (e.g. less demand for disposable plastics such as plastic bags, more demand for electric car components).

This sustainable scenario, with fewer emissions and more recycling, reduces the demand for new basic chemicals by 7 percent compared to the baseline scenario. Considerable efforts in recycling are therefore useful, but not sufficient to meet market demand. The production of new ethylene and propylene, as Project ONE will do, provides an answer to society’s need for these basic building blocks.

[1] The Clean Tech Scenario (CTS) by 2050 includes a 45% reduction in direct CO2 emissions from chemistry despite a 40% increase in demand for basic chemicals. It also includes a (nearly) tripling of the global average collection rate of plastic waste.

-

Should INEOS focus more on recycling instead of producing new plastics?

INEOS is strongly committed to reduce plastic waste. It is not the plastics themselves that are the problem, but the fact that they are thrown away in to the environment, sent to landfill, or incinerated. According to INEOS’ vision, we have to handle plastics with care, precisely because they are such valuable materials. That’s why INEOS invests heavily to support the recycling of plastics. In this way, all polymers produced by us (such as polyethylene and polypropylene produced on the basis of Project ONE-output) can be fully recycled.

INEOS is investing to support different forms of recycling. We develop products that lend themselves to mechanical recycling so that recycled material can also be used for high-quality applications, and we incorporate recycled plastics in to our products. We invest in the development of our processes to use bio-based raw materials or waste plastics as raw materials for new plastics. Advanced recycling (also called chemical recycling) is a developing technology. As we commercialize this technology, we will be able to produce more plastic from recycled products, creating a market for waste plastic.

All this is in line with our commitment of the INEOS Pledge, as plastics are a valuable material. We have committed to incorporate at least 850 000 tonnes of recycled and bio-attributed material in our polymer products by 2030. We previously committed to use an average of 30% recycled material in products for polystyrene packaging in Europe by 2025; to market a range of polyolefin products for packaging in Europe with at least 50% recycled material, to ensure that 100% of our polymers are recyclable.

Here are some concrete examples:

– When you see packaging, you don’t see that it consists of several layers. In fact, all those different layers have specific functions: rigidity, transparency, printability, sealability, barrier…. And to exploit each of these qualities, different materials are combined. Moreover, additional layers are needed to make all those layers compatible. However, these many layers also make packaging more difficult to recycle.

That is why the colleagues at our R&D centre in Neder-Over-Heembeek focused on “mono-materials“. Thus, they developed an upright bag packaging in mono-material that consists of more than 95% polyethylene and is fully recyclable. Indeed, polyethylene has emerged as one of the best monomaterials because of its intrinsic qualities and because the recycling chain was already in place.

It also produced a second rigid MDO monomaterial roll with more than 50% plastic waste – an absolute first in the market. This was helped by the investment in a high-tech, multi-layer MDO line to work with customers to develop solutions that they can apply directly to their own production lines.

Read more about it in this report on our R&D centre in Neder-Over-Heembeek– Upgrading plastics for successful combination with recycled material Each time a polymer (such as polyethylene and polypropylene) is mechanically recycled, the quality of the material decreases. This is why these recyclates are usually used in low performance and rather inexpensive end applications such as flower pots and garbage bags. The goal of INEOS is to increase the value of recycled polymers so that they are equivalent to ‘virgin’ plastics. In our research centre in Neder-Over-Heembeek we have succeeded in making products that meet the demanding performance characteristics required by our customers, whilst containing more than 50% of recycled plastic. These products are now fully commercialised under our Recyl-IN brand name.

– Advanced (chemical) recycling of polyethylene and polypropylene. Instead of making plastics based on naphtha (from crude oil), INEOS has started a partnership with the recycling company Plastic Energy to break down used polyethylene and polypropylene to their base molecules so that they can be reused as a new feedstock. After first successful tests in 2020, INEOS and Plastic Energy are now developing a project to build a new installation that can carry out this process on a large scale.

– Depolymerization of styrene. INEOS Styrolution has already made a breakthrough for chemical recycling by depolymerizing polystyrene waste: laboratory scale production of new polystyrene based on recycled styrene monomers. For example, old yoghurt jars can be reused half in new products. This happens at the site of Styrolution in Antwerp, the largest polystyrene installation in Europe. Soon a partnership will be entered into with waste processing company INDAVER whereby polystyrene waste will be recycled into pure styrene monomers. Already in 2022, a demo plant will be operational that will be able to recycle 15,000 tons. This project fits in Styrolution’s efforts to make plastic products based on waste or renewable raw materials.

-

Does Project ONE make raw materials for disposable products?

Project ONE produces ethylene, a gaseous substance that is an essential building block of chemistry. On the basis of these substances, further down the production chain, products will be made that are inextricably linked to our contemporary life. Just think about it:

- Personal care products such as contact lenses, eyewear, toothbrushes, and cosmetics.

- Electronics such as mobile phones, computers, and coffee machines.

- Essential utilities and applications for our homes such as pipes for transporting drinking water or gas, window frames and doors.

- Healthcare applications such as mouth masks, face shields, syringes, medications and blood/plasma bags.

- Things we use in our leisure time, such as sports equipment and clothing, outdoor furniture, and a TV.

- Products that contribute to a sustainable society such as insulation materials, lightweight parts for cars, solar panels, lubricants for wind turbines, and wind turbine blades.

Most of the INEOS Group’s production is for such applications in construction, automotive, household appliances and the like. Part of INEOS Group’s end products, concerns packaging for the food industry. Packaging is sometimes reviled, but it is important to improve the safety and shelf life of products.

For example, the packaging of a cucumber improves its shelf life by about 11 days. Because there is less food waste, the packaging saves 5 times as much CO2 as was needed to produce it. Alternatives to plastic packaging, such as paper, glass and aluminum, use more resources such as energy and water, and may also require the use of plastics to deliver the required performance. This can result in higher CO2 emissions (see TED-talk by UGent professor Kim Ragaert).

-

Will shale gas come to Antwerp?

No. Ethane – one of the raw materials for Project ONE – is a by-product of natural gas, which we import to Antwerp by ship.

The United States extracts natural gas for local energy supply. The vast majority of this gas is methane, but it also contains smaller amounts of ethane, butane and propane. For the petrochemical industry, the ‘by-product’ ethane gas is very valuable as it is an important feedstock that can be converted into high-value chemicals. The ethane gas is thus put to good use and avoided being released directly into the atmosphere via flaring.

Shale gas suffers from a negative image. This goes back to the early years when there were teething problems. Meanwhile, the industry has professionalised over 20 years and there are strict rules for start-up and operation.

INEOS works with ethane suppliers committed to reducing greenhouse gas emissions and methane loss to an absolute minimum. Leading suppliers such as Range Resources (with 0.013% methane loss by 2022, a 69% reduction compared to 2019). Antero and SWN are also actively working to minimise their environmental impact and report their progress to government and sustainability bodies (see Range Resources and Antero sustainability reports).

Moreover, the ethane gas that INEOS imports into Antwerp is transported by ships powered by ethane gas instead of heavy fuel oil. This use of gas as fuel reduces sulphur and carbon dioxide emissions compared to conventional fuels, contributing to cleaner and more environmentally friendly logistics.

Does Project ONE promote shale gas extraction in the US?

The claim that Project ONE has a significant impact on shale gas volume is completely unfounded. In 2022, the United States produced 28.6 trillion cubic feet (Tcf) of shale gas, as reported by the US Environmental Protection Agency (EPA). Converted into tonnages, this amounts to 600 million tonnes per year. To put this into perspective: Project ONE uses just under 2 million tonnes of ethane, representing about 0.33% of the total amount of shale gas produced in the US.